Qantas/Emirates tie-up: the initial results are in

July 3, 2013 Leave a comment

Introduction

The first data since the Qantas/Emirates tie-up has been released and we can start to examine the performance of the respective players under the new state of affairs. In short, the new Qantas/Emirates tie-up has resulted in:

- Qantas and Emirates extensively code-sharing on each other’s flights between Australia, Dubai and Europe (but no revenue-sharing);

- Qantas ditching its joint business venture with British Airways on the Australia to UK/Europe routes;

- Qantas routing its Melbourne to London and Sydney to London services via Dubai instead of Singapore; and

- BA replacing its old 747 product on the Sydney route with its newest product, the 777-300ER.

Let’s crunch the limited data we have available. The big disclaimers are that:

- whilst loads are an indicator of a route’s performance, information on yields (ie fares paid) is also required to assess how profitable a route is; and

- there is incomplete data on the routes between Asia/Middle East and London and we need to make some assumptions based on scheduling ‘rules of thumb’.

I have not been able to find the time to update this blog over the last 12 months, but hope to do so more regularly. These posts usually require a solid few hours of number-crunching and research (the writing is the easy part). My sincerest thanks to anyone who has stuck around!

Passenger flows on the Kangaroo route services.

The key flows on the Kangaroo route through-services are shown in the diagram below:

The major observations:

- Virgin Atlantic is primarily an Australia to Asia operator in the Australian market. This reflects Virgin’s shortage of capacity on the London to Hong Kong route and the higher yields available on the Sydney to Hong Kong route (relative to BA’s Sydney to Singapore leg).

- BA, in contrast, is primarily using their flight as an Australia to UK service.

- Qantas is carrying some traffic to Dubai (presumably connecting to Emirates’ small 3AM European departure bank) but London is the main-game for these flagship flights.

Although there is no data on the Asia/Middle East to London sectors, we can assume that:

- BA is doing well on the Singapore to London route given the recent reduction in capacity on that route, Singapore Airlines’ recent addition of a fourth daily service and BA’s mentions of Singapore getting an A380;

- Virgin Atlantic are filling up their planes between Hong Kong and London given that they offer so little capacity on that route; and

- Qantas, by virtue of their status as a ‘fifth freedom’ carrier between Dubai and London, attracts less profitable traffic (BA and VS both have heavy customer bases in the UK).

Questionable future for Melbourne – London

When you operate an A380 from Australia-midpoint-London, you need passengers getting on at the midpoint to replace those passengers that flew from Australia-midpoint. When Singapore was the intermediate stopover, passengers from Brisbane, Perth, Adelaide and Auckland would replace the passengers who got off at Singapore.

Many passengers are getting off the Qantas planes at Dubai rather than carrying onto London. It is therefore unclear how Qantas is filling up its twice daily A380s between Dubai and London given that:

- Emirates is more likely to put their passengers on their own planes than give them to Qantas (because, unlike the QF/BA relationship, the QF/EK tie-up is not a revenue sharing joint venture);

- Qantas has little marketing presence in Dubai and little local recognition; and

- airlines operating between two foreign countries generally struggle to fill up those planes with anything other than cheap, unprofitable fares.

To add two data points, I recently enjoyed a row to myself between Dubai and London on Qantas.

There are two factors counting in favour of Qantas retaining QF9 beyond Dubai:

- Qantas justified its Emirates alliance to the ACCC partially on the grounds that Melbourne would lose its London flight if the alliance was not approved (Qantas submission to ACCC, part 7.6, para 6). Cutting the route after the ACCC approved the alliance would discredit Qantas.

- Qantas’ premium 5:30 and 6:30 arrival times into Heathrow are of value to Emirates passengers and Emirates may be directing flows onto the Qantas services. Qantas’ early AM Heathrow slots are the scheduling equivalent of the top end of Collins Street and Emirates has no slots until 7AM.

Singapore struggles

It turns out that Qantas’ Singapore services were being largely propped-up by people wanting to visit UK/Europe and that Singapore is struggling as a destination in its own right. One disadvantage that Qantas has on its Australia to Singapore routes is that it is heavily dependent on origin-destination traffic (ie people who want to go to Singapore itself) as it lacks an extensive full-service partner at Singapore Airport.

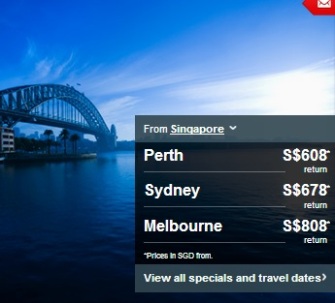

The above screenshot (prices in Singaporean dollars) shows Qantas is relying on heavy discounting and that the twice daily Sydney services are struggling the most.

BA giving Sydney a red-hot go

British Airways’ core business is operating a monorail between the UK and the US (ie trans-Atlantic flying) and its parent company claims that the “future” lays in increasing a presence in Asia. In short, Australia is (sadly) not a core part of their business.

This made it all the more surprising when BA, in response to being dropped by Qantas, decided to:

- replace its 747 on the London-Singapore-Sydney route with the 777-300ER to both increase fuel efficiency and provide a more desirable product;

- start marketing within Australia (it had traditionally relied on Qantas to sell its seats) including emphasising that its services continue to stop in Singapore;

- operate the flight to/from Heathrow Terminal 5 (which is nicer than the previous Terminal 3);

- take on Cathay as an Asia-Australia codeshare partner, undoubtedly on terms quite favourable to Cathay; and

- roll out a lower cost cabin crew to reduce the route’s costs.

The flows indicate that BA is focuses on the Australia to UK market whilst its counterpart Virgin Atlantic focuses on the Australia to Asia market. Given that the Sydney to Singapore route is hard-going in terms of yields, there may be an argument for BA to swap its intermediate stopover to another location (it might be worth giving Qatar a call) where it can perform better on the leg into Sydney.